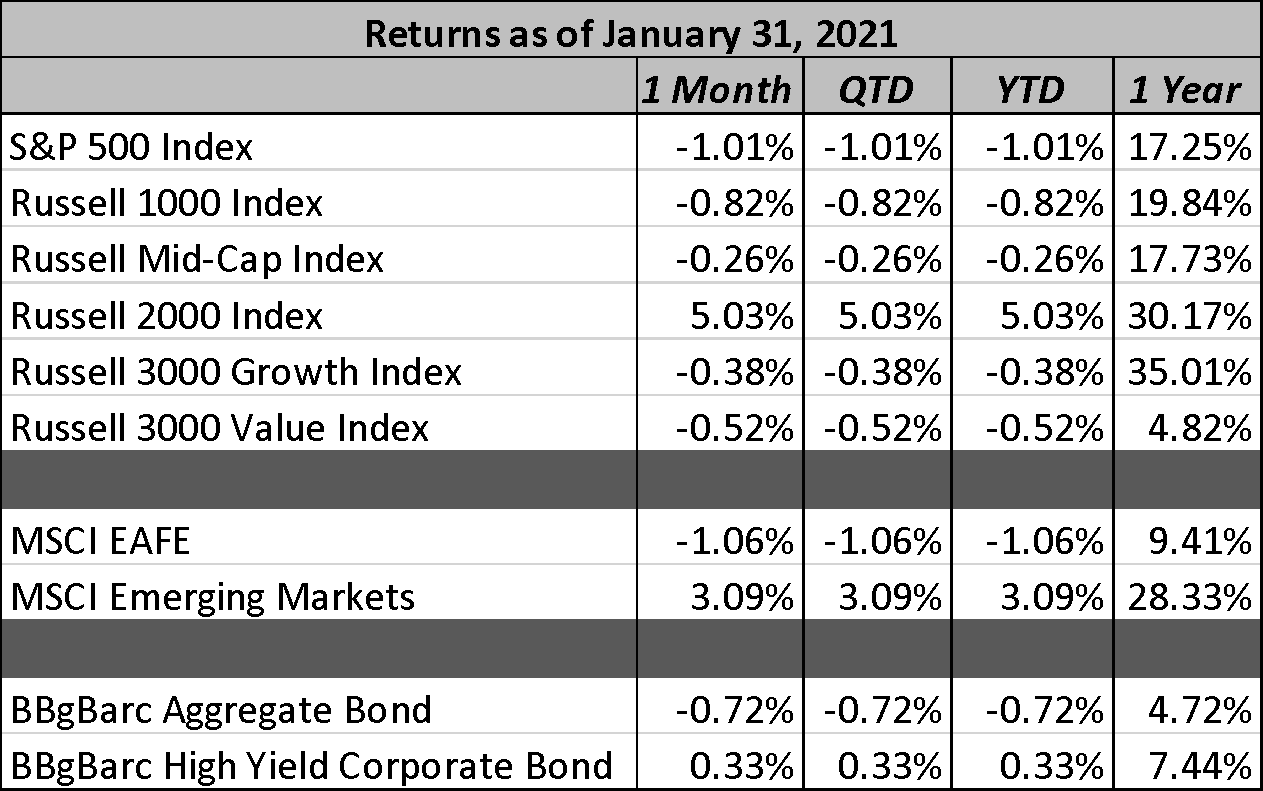

2021 is off to a rocky start as equity markets declined across the board. The S&P 500 Index fell -1.01%. The world was captivated by the trading frenzy over heavily shorted stocks such as GameStop (GME) and AMC Entertainment Holdings (AMC), which drove volatility in equities to the highest levels since October. The lone bright spot was small cap stocks which continued their run of outperformance, ending the month up +5.03%.

To say that month was crazy for the markets seems like a bit of an understatement. Rampant speculation being driven by anonymous investors on a Reddit chat board called “Wall Street Bets” captivated the headlines, as what seemed to be a David versus Goliath scenario played out in one of the most public short squeezes seen in years. As retail investors jumped on board in the hopes of beating the big hedge funds at their own game, hedge funds seemed to be on their heels, cutting bets by decreasing their long equity positions to cover short bets that had turned against them, causing downward pressure across the equity markets. The drama heightened as retail brokerage firm Robinhood suspended buying activity in the targeted stocks and closed out many investors existing positions. The sensational headlines caught the eye of the regulators and politicians who immediately demanded answers and solutions to protect retail investors, despite their clear willingness to participate in the speculation.

The challenge in moments of frenzy is being able to look beyond the noise and focus on the broader picture. Very little attention has been paid to the strong earnings that have been reported thus far. According to FactSet with 37% of the companies in the S&P 500 reporting actual results, 82% of S&P 500 companies have reported a positive EPS surprise and 76% have reported a positive revenue surprise. If 82% is the final percentage, it will mark the second-highest percentage of S&P 500 companies reporting a positive EPS surprise since FactSet began tracking this metric in 2008. Improving economic data and the increasing pace of vaccinations in the U.S. continue to support rising equity prices in the near term. While the headlines focus on the frenzy, smart investors have an opportunity to buy quality companies at an attractive price, setting themselves up to take advantage of the explosion of pent-up demand that is anticipated in the second half of the year. While it is easy to get caught up in the excitement, I would not allow the temptation to earn a quick buck in the battle against the shorts distract from the more lucrative opportunity that such a frenzy presents smart investors who are focused on the long-term.