Market Commentary

Market Commentary

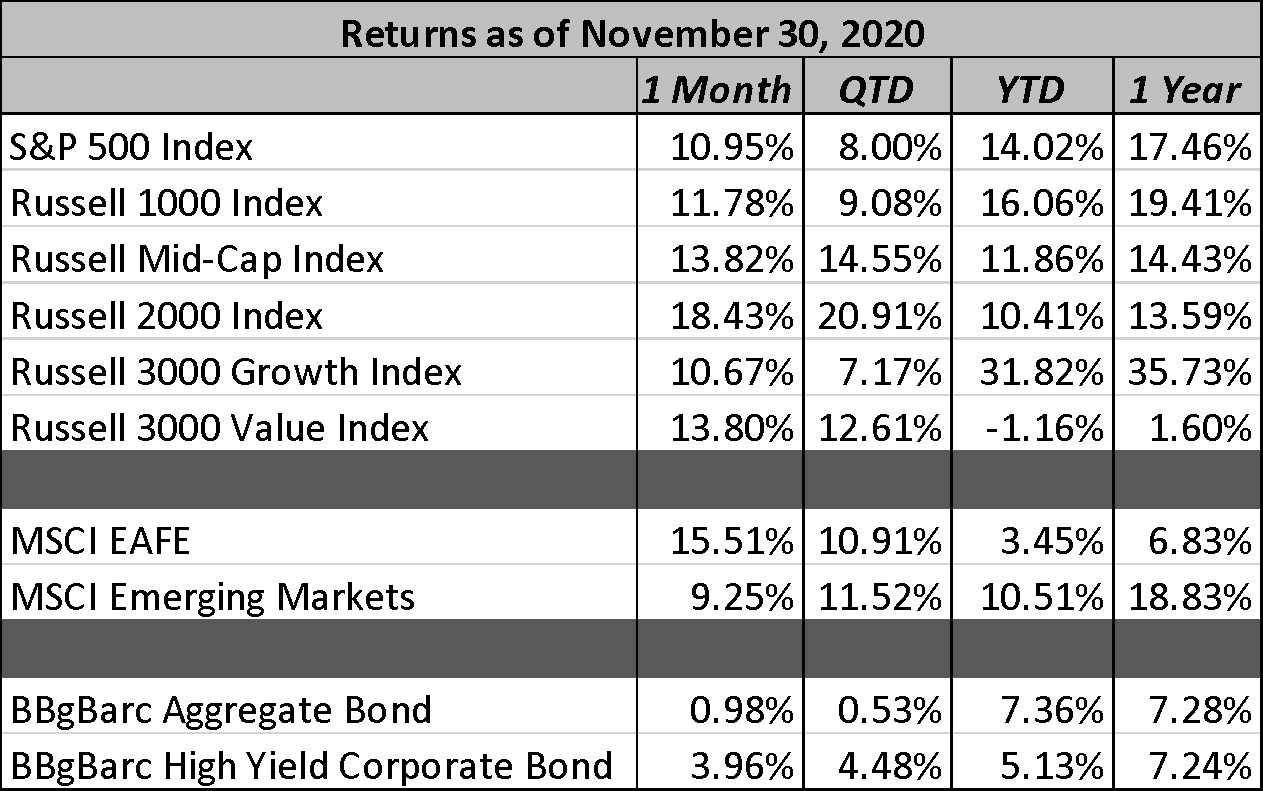

As the markets shook off the election uncertainty of October and positive vaccine news dominated the headlines, equity markets quietly drove toward record highs in November. Additionally, as investors breathed a sigh of relief that checks and balances would remain in place within the federal government, increased optimism of renewed fiscal stimulus rose. The S&P 500 finished the month higher +10.95%.

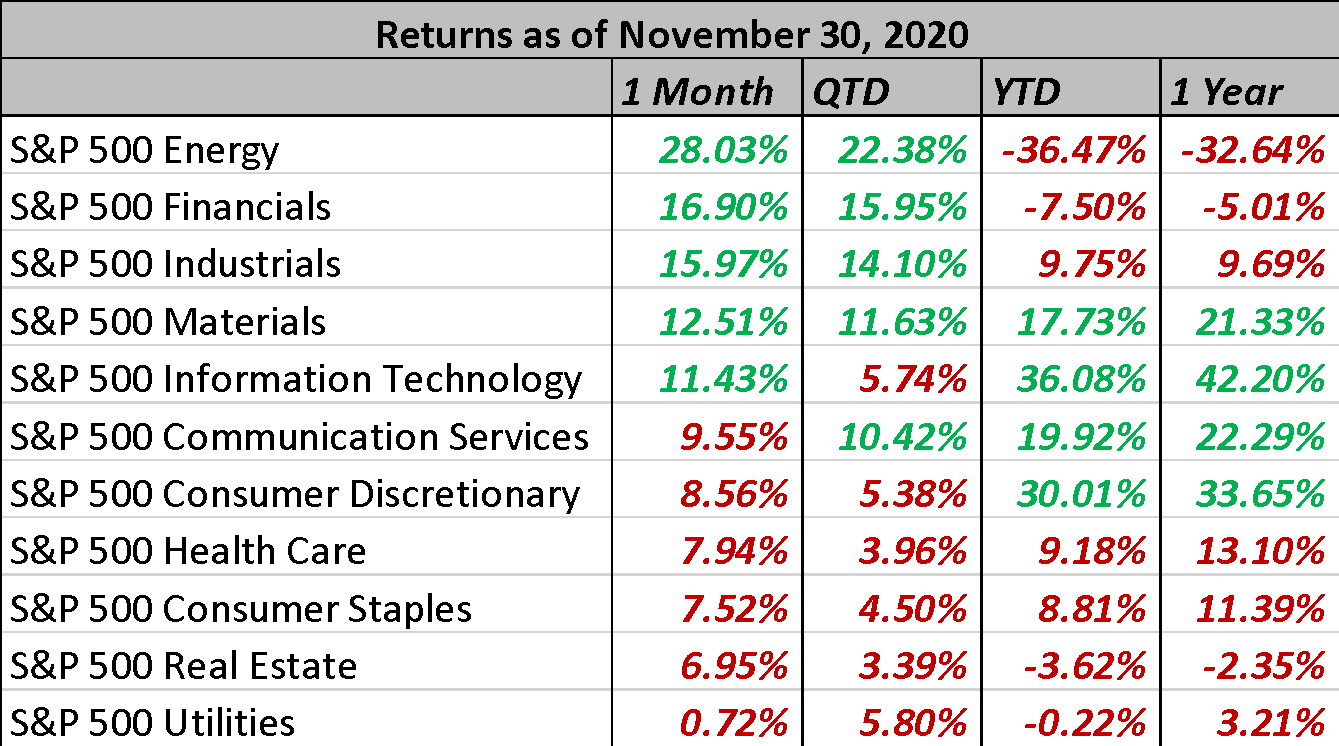

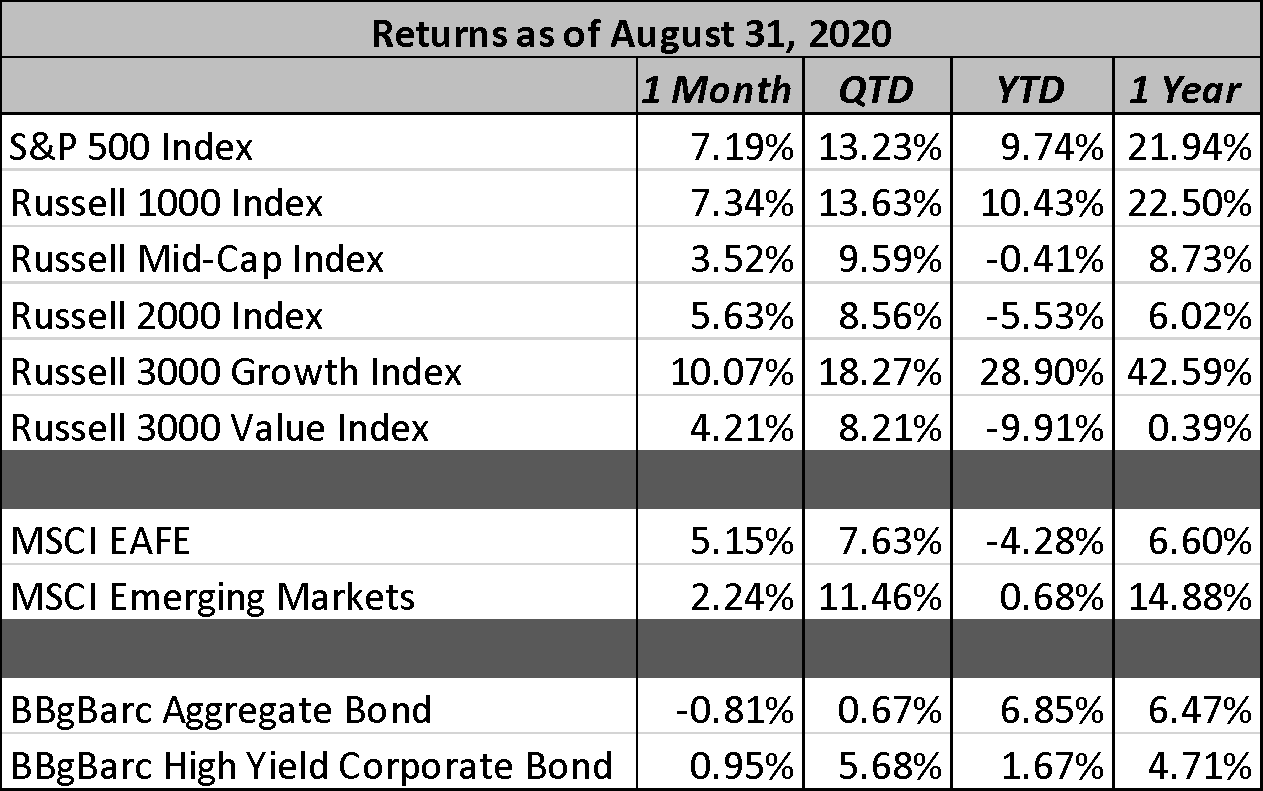

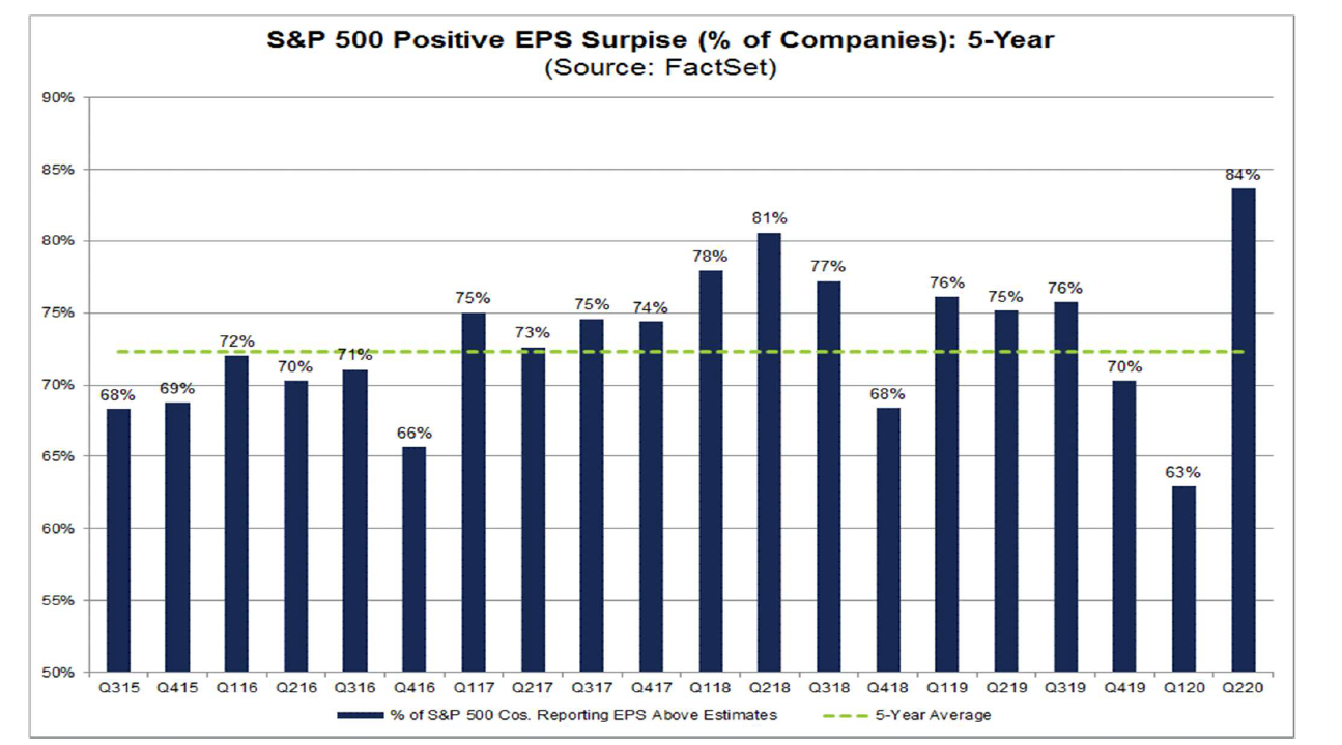

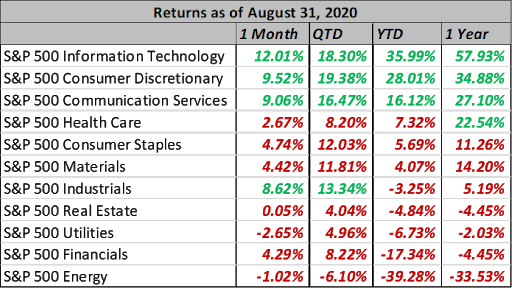

Mondays in November seemed to be for positive vaccine news. As it became increasingly apparent that the end of the pandemic was nearing, investors began to rotate their equity exposure by moving their allocations from sectors and industries that benefitted from the lockdowns and shifting to more cyclical names badly hurt by the restrictions of the pandemic. All 11 major sectors of the index were positive on a total return basis. Energy, a perpetual laggard, saw the greatest rebound during the month, returning a whopping +28.03%.

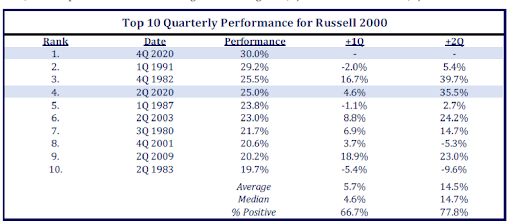

Small cap stocks continued to blaze a trail forward. The Russell 2000 Index ended November +18.43%, putting small cap stocks on pace for their best quarter in history.

Source: Strategas Technical Strategy Daily Report, December 16, 2020

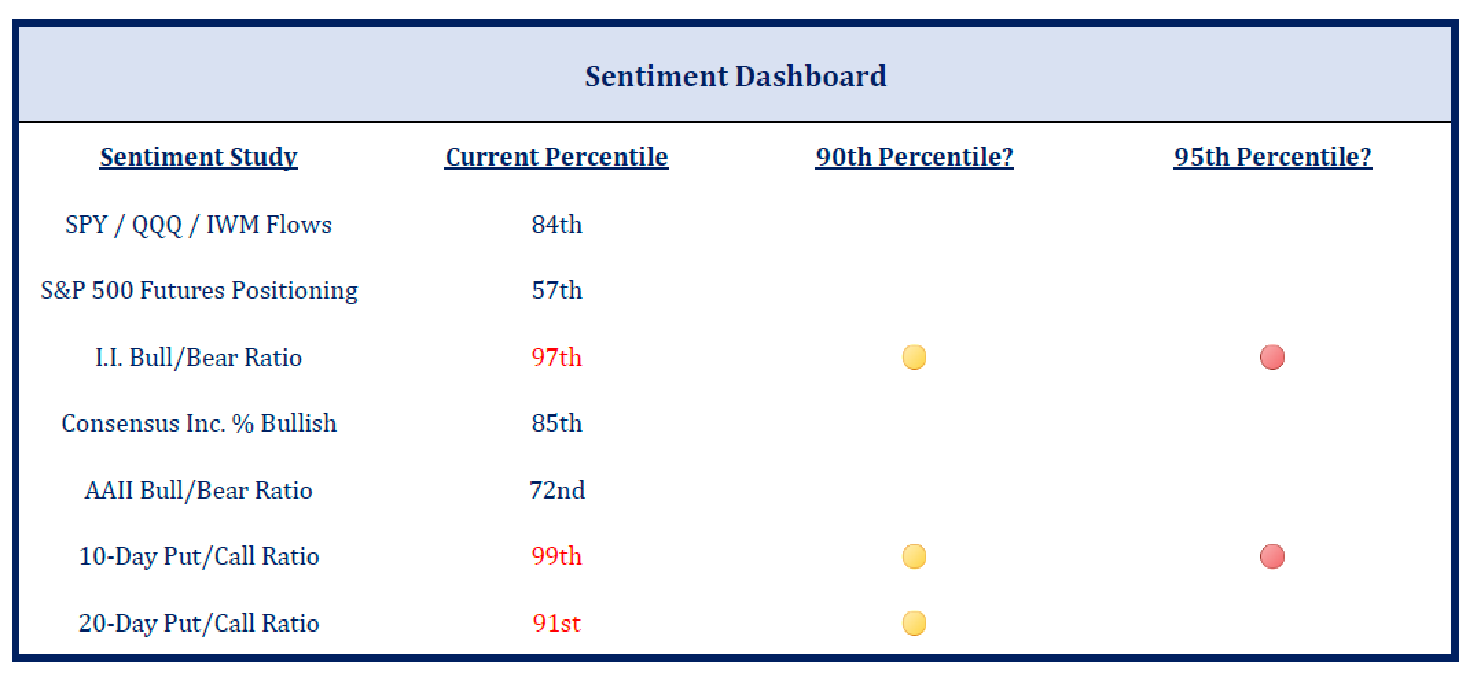

In my opinion, the biggest risk to the market is that it is too optimistic. As I have personally witnessed, anyone who suggests near-term caution is viewed as a little out of touch, but signs persist that we may see real economic weakness in the coming months. The market doesn’t appear to be accounting for this weakness. Strategas’ Sentiment Dashboard currently shows that signs of bullishness are more pronounced, with three statistically extreme readings among the basket of sentiment indicators.

Source: Strategas Technical Strategy Daily Report, November 30, 2020

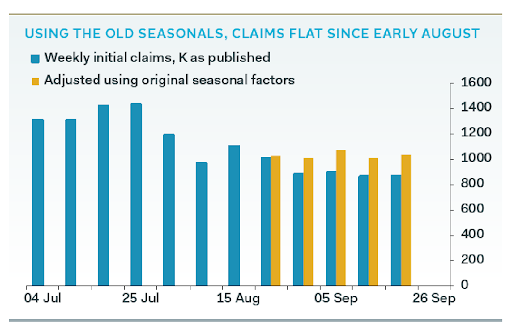

While sentiment is bullish, the double dip in Europe is clear. Lockdowns overseas have had serious economic consequences and there are signs that the United States could see similar results. Consumer sentiment and consumer confidence came in below consensus during November, weekly jobless claims are rising, and personal income fell in October. Fiscal stimulus continues to be incredibly important at this juncture. More and more individuals are shifting to emergency unemployment benefits, which are currently at risk of expiring. State & local governments continue to seek aid from Washington to support the growing health care burden. The biggest concern is the survival of small businesses. Many small businesses are making decisions on whether to close, or to continue to give it a go for a few more months. It is reasonable that the broader macro economy can look past some of these items (for example, if a restaurant closes, another will likely take its place in the future). Unfortunately, the costs of the pandemic are falling on those least able to bear it, which only increases the urgency for overdue stimulus, especially if the U.S. labor market data weakens more significantly.

2021 is certainly going to be a year where the story is about pent up demand as vaccines allow for lives and economies to begin to return to normal. The question is how difficult will the climb be from now until then? Only time will tell.

This material was prepared by the Spotlight Asset Group (“SAG”) Chief Investment Officer (“CIO”) and is presented for information purposes only. The views offered are those of the author and are subject to change. This information is not intended to provide investment advice or solicit or offer investment advisory services. All information and data presented herein has been obtained from sources believed to be reliable and is believed to be accurate as of the time presented, but SAG does not guarantee its accuracy. You should not make any financial, legal, or tax decisions without consulting with a properly credentialed and experienced professional. Investing involves risk and past performance is no guarantee of future results.

Join the Spotlight Asset Group Newsletter

Market Commentary

As the markets shook off the election uncertainty of October and positive vaccine news dominated the headlines, equity markets quietly drove toward record highs in November. Additionally, as investors breathed a sigh of relief that checks and balances would remain in place within the federal government, increased optimism of renewed fiscal stimulus rose. The S&P 500 finished the month higher +10.95%.

Mondays in November seemed to be for positive vaccine news. As it became increasingly apparent that the end of the pandemic was nearing, investors began to rotate their equity exposure by moving their allocations from sectors and industries that benefited from the lockdowns and shifting to more cyclical names badly hurt by the restrictions of the pandemic. All 11 major sectors of the index were positive on a total return basis. Energy, a perpetual laggard, saw the greatest rebound during the month, returning a whopping +28.03%.

Small cap stocks continued to blaze a trail forward. The Russell 2000 Index ended November +18.43%, putting small cap stocks on pace for their best quarter in history.

Source: Strategas Technical Strategy Daily Report, December 16, 2020

In my opinion, the biggest risk to the market is that it is too optimistic. As I have personally witnessed, anyone who suggests near-term caution is viewed as a little out of touch, but signs persist that we may see real economic weakness in the coming months. The market doesn’t appear to be accounting for this weakness. Strategas’ Sentiment Dashboard currently shows that signs of bullishness are more pronounced, with three statistically extreme readings among the basket of sentiment indicators.

Source: Strategas Technical Strategy Daily Report, November 30, 2020

While sentiment is bullish, the double dip in Europe is clear. Lockdowns overseas have had serious economic consequences and there are signs that the United States could see similar results. Consumer sentiment and consumer confidence came in below consensus during November, weekly jobless claims are rising, and personal income fell in October. Fiscal stimulus continues to be incredibly important at this juncture. More and more individuals are shifting to emergency unemployment benefits, which are currently at risk of expiring. State & local governments continue to seek aid from Washington to support the growing health care burden. The biggest concern is the survival of small businesses. Many small businesses are making decisions on whether to close, or to continue to give it a go for a few more months. It is reasonable that the broader macro economy can look past some of these items (for example, if a restaurant closes, another will likely take its place in the future). Unfortunately, the costs of the pandemic are falling on those least able to bear it, which only increases the urgency for overdue stimulus, especially if the U.S. labor market data weakens more significantly.

2021 is certainly going to be a year where the story is about pent up demand as vaccines allow for lives and economies to begin to return to normal. The question is how difficult will the climb be from now until then? Only time will tell.

This material was prepared by the Spotlight Asset Group (“SAG”) Chief Investment Officer (“CIO”) and is presented for information purposes only. The views offered are those of the author and are subject to change. This information is not intended to provide investment advice or solicit or offer investment advisory services. All information and data presented herein has been obtained from sources believed to be reliable and is believed to be accurate as of the time presented, but SAG does not guarantee its accuracy. You should not make any financial, legal, or tax decisions without consulting with a properly credentialed and experienced professional. Investing involves risk and past performance is no guarantee of future results.