An Update Regarding Market Volatility

Recent market volatility during the month of May has made many investors nervous and for good reason. The market is in the midst of a change in momentum and the shift has been sudden. First, it’s important to note, the U.S. economy is recovering rapidly from the COVID-19 pandemic. Many different factors are at play in the recovery: the rollout of vaccines, the lifting of restrictions, loose monetary policy, and a massive increase in government spending. The problem is that the massive government “stimulus” checks have put the economy in a strange position, where retail sales are far above where they would be if COVID had never happened, even as the production side of the economy remains relatively weak. Pandemic unemployment benefits, paired with lack of childcare options has resulted in a strange dynamic for employment, plenty of jobs and not enough job seekers. Add to that the inflationary effect of the economic recovery and suddenly we find ourselves with very unusual market dynamics.

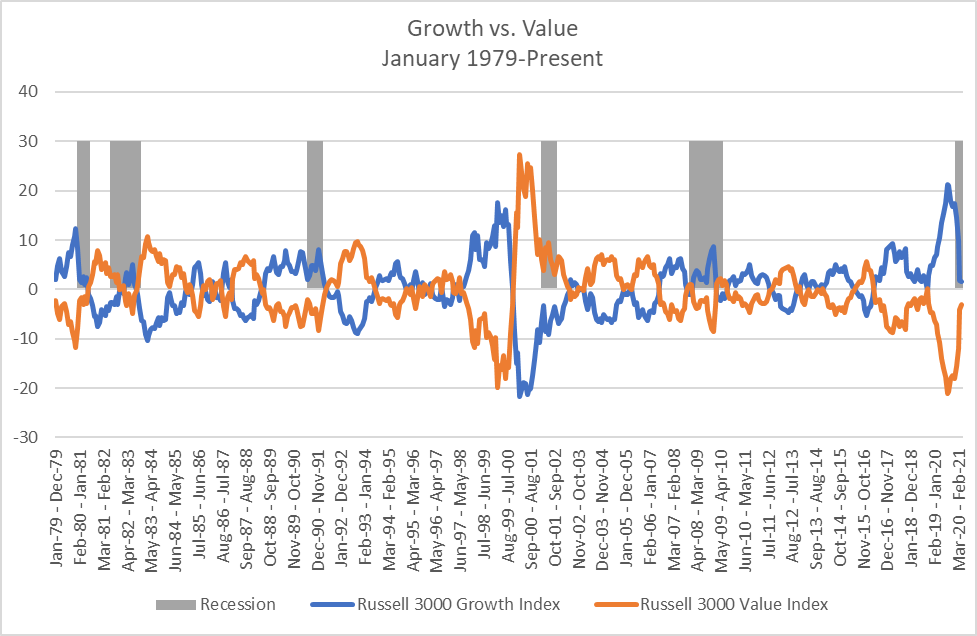

One of the questions we are most frequently asked is about the rotation from growth to value. Growth stocks tend to be companies that are smaller or are in more volatile sectors of the market like technology. Tesla would be a good example of a growth company. Value companies are usually larger and are more likely to be staples of the economy. Walmart would be a good example of a value stock. This rotation from growth to value which began in October, is not an unusual market event. Growth had been outperforming value for the better part of a decade, as economic conditions strongly favored growth stocks (interest rates trending lower, inflation at historically low levels, slow and steady economic growth). The chart below illustrates the relationship between growth and value over time.

Source: MPI Stylus

Typically, value does best in the recovery stage of a recession when interest rates are moving upwards and when inflation is rising. Value sectors like energy, materials and financials thrive under those conditions.

At Spotlight we anticipated this shift and began positioning our portfolios accordingly earlier this year. Specifically, we added more active managers to our investments over the last several months. We believe active management is more successful when the market is more volatile, and we feel we have had success in selecting high quality active managers. The table shown below illustrates how well our active managers have performed in the last 12 months. All our active equity managers are outperforming the S&P 500. This is even more apparent in the fixed income space, as all four of our fixed income strategies are actively managed, and all four are handily beating the Barclays U.S. Aggregate benchmark.

Additionally, over the past year we have implemented a risk budgeting approach to our portfolio construction. Rather than of only looking at whether we want to overweight/underweight equities, our Investment Committee is now focused on the amount of risk we are taking with each model. Our first step in constructing portfolios is to decide if we want to be overweight, equal weight, or under-weight risk compared to our benchmarks. Currently all of our portfolios are equal weight to risk. We then decide which areas of the market appear to be the most likely to out-perform and will use our “risk budget” to select excellent managers in those asset classes. Our goal has been to take on risk where the upside potential is most attractive. Currently, in most models, we have used our risk budget to increase exposure to Value, Small/Mid Cap Companies, and Alternative funds that can go Long or Short equities depending on how the manager feels the market will perform. Given this approach, we are comfortable that we have positioned our portfolios well for the current market conditions and believe that this approach will help you reach your long-term goals. As always, we are here to address your questions or concerns.

This material was prepared by the Spotlight Asset Group (“SAG”) Chief Investment Officer (“CIO”) and is presented for information purposes only. The views offered are those of the author and are subject to change. This information is not intended to provide investment advice or solicit or offer investment advisory services. All information and data presented herein has been obtained from sources believed to be reliable and is believed to be accurate as of the time presented, but SAG does not guarantee its accuracy. You should not make any financial, legal, or tax decisions without consulting with a properly credentialed and experienced professional. Investing involves risk and past performance is no guarantee of future results.

Join the Spotlight Asset Group Newsletter

An Update Regarding Market Volatility

Recent market volatility during the month of May has made many investors nervous and for good reason. The market is in the midst of a change in momentum and the shift has been sudden. First, it’s important to note, the U.S. economy is recovering rapidly from the COVID-19 pandemic. Many different factors are at play in the recovery: the rollout of vaccines, the lifting of restrictions, loose monetary policy, and a massive increase in government spending. The problem is that the massive government “stimulus” checks have put the economy in a strange position, where retail sales are far above where they would be if COVID had never happened, even as the production side of the economy remains relatively weak. Pandemic unemployment benefits, paired with lack of childcare options has resulted in a strange dynamic for employment, plenty of jobs and not enough job seekers. Add to that the inflationary effect of the economic recovery and suddenly we find ourselves with very unusual market dynamics.

One of the questions we are most frequently asked is about the rotation from growth to value. Growth stocks tend to be companies that are smaller or are in more volatile sectors of the market like technology. Tesla would be a good example of a growth company. Value companies are usually larger and are more likely to be staples of the economy. Walmart would be a good example of a value stock. This rotation from growth to value which began in October, is not an unusual market event. Growth had been outperforming value for the better part of a decade, as economic conditions strongly favored growth stocks (interest rates trending lower, inflation at historically low levels, slow and steady economic growth). The chart below illustrates the relationship between growth and value over time.

Typically, value does best in the recovery stage of a recession when interest rates are moving upwards and when inflation is rising. Value sectors like energy, materials and financials thrive under those conditions.

At Spotlight we anticipated this shift and began positioning our portfolios accordingly earlier this year. Specifically, we added more active managers to our investments over the last several months. We believe active management is more successful when the market is more volatile, and we feel we have had success in selecting high quality active managers. The table shown below illustrates how well our active managers have performed in the last 12 months. All our active equity managers are outperforming the S&P 500. This is even more apparent in the fixed income space, as all four of our fixed income strategies are actively managed, and all four are handily beating the Barclays U.S. Aggregate benchmark.

Additionally, over the past year we have implemented a risk budgeting approach to our portfolio construction. Rather than of only looking at whether we want to overweight/underweight equities, our Investment Committee is now focused on the amount of risk we are taking with each model. Our first step in constructing portfolios is to decide if we want to be overweight, equal weight, or under-weight risk compared to our benchmarks. Currently all of our portfolios are equal weight to risk. We then decide which areas of the market appear to be the most likely to out-perform and will use our “risk budget” to select excellent managers in those asset classes. Our goal has been to take on risk where the upside potential is most attractive. Currently, in most models, we have used our risk budget to increase exposure to Value, Small/Mid Cap Companies, and Alternative funds that can go Long or Short equities depending on how the manager feels the market will perform. Given this approach, we are comfortable that we have positioned our portfolios well for the current market conditions and believe that this approach will help you reach your long-term goals. As always, we are here to address your questions or concerns.

This material was prepared by the Spotlight Asset Group (“SAG”) Chief Investment Officer (“CIO”) and is presented for information purposes only. The views offered are those of the author and are subject to change. This information is not intended to provide investment advice or solicit or offer investment advisory services. All information and data presented herein has been obtained from sources believed to be reliable and is believed to be accurate as of the time presented, but SAG does not guarantee its accuracy. You should not make any financial, legal, or tax decisions without consulting with a properly credentialed and experienced professional. Investing involves risk and past performance is no guarantee of future results.