Market Commentary

As the third quarter came to a close, the month of September was a difficult one for stocks. Global equity markets finished in the red after 5 straight months of gains. The S&P 500 lost -3.80% during the month. Only 2 of the 11 GIC sectors were positive during the month. Momentum previously seen in technology and communication services stalled, as those sectors declined -5.37% and -6.47% respectively. The declines continued to hit the energy sector the hardest, as the sector declined -14.51% during the month. The sector is now down a whopping -48.09% for the year.

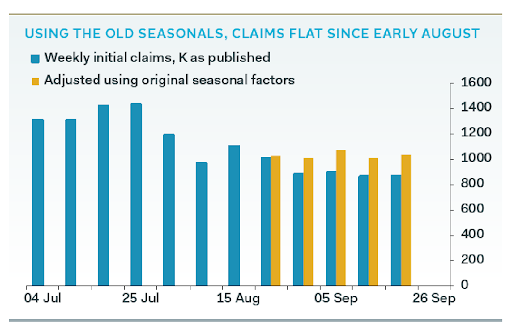

With just over a month to go, the focus has begun to turn to the upcoming presidential election, with both Democrats and Republicans searching for an edge with voters. This shift of focus paired with the battle over the now vacant supreme court seat, following the passing of Justice Ruth Bader Ginsburg, has made the prospects of another round of fiscal stimulus unlikely. The lack of additional stimulus makes the impact of the COVID-19 limitations weigh on many sectors, especially those that are service related, likely stalling any additional economic improvements in the U.S. This is already evident in the labor markets. Initial jobless claims have been flat since late August and small business employment has begun to show signs of weakness.

Despite the doom and gloom, the market correction we have experienced in September should be viewed positively. Throughout the summer months the market seemed to get well ahead of itself and valuations have come down from their highs in August. Market corrections are healthy and normal. They act as a self-correcting mechanism often chasing away speculators. Corrections also provide investors with more attractive entry points into stocks that have strong momentum and sustainable long-term earnings growth. Overall, September was difficult but not necessarily a sign of impending doom. As we enter the final stretch of 2020, we all want to focus on 2021, putting this difficult year behind us. However, I caution you from ignoring the fact that the remaining months of 2020 are likely to be just as unpredictable and volatile as the 9 months that proceeded them. There will likely be more opportunities to take advantage of technical and fundamental dislocations as investor behavior continues to be heavily influenced by the headlines.

This material was prepared by the Spotlight Asset Group (“SAG”) Chief Investment Officer (“CIO”) and is presented for information purposes only. The views offered are those of the author and are subject to change. This information is not intended to provide investment advice or solicit or offer investment advisory services. All information and data presented herein has been obtained from sources believed to be reliable and is believed to be accurate as of the time presented, but SAG does not guarantee its accuracy. You should not make any financial, legal, or tax decisions without consulting with a properly credentialed and experienced professional. Investing involves risk and past performance is no guarantee of future results.

Join the Spotlight Asset Group Newsletter

Market Commentary

As the third quarter came to a close, the month of September was a difficult one for stocks. Global equity markets finished in the red after 5 straight months of gains. The S&P 500 lost -3.80% during the month. Only 2 of the 11 GIC sectors were positive during the month. Momentum previously seen in technology and communication services stalled, as those sectors declined -5.37% and -6.47% respectively. The declines continued to hit the energy sector the hardest, as the sector declined -14.51% during the month. The sector is now down a whopping -48.09% for the year.

With just over a month to go, the focus has begun to turn to the upcoming presidential election, with both Democrats and Republicans searching for an edge with voters. This shift of focus paired with the battle over the now vacant supreme court seat, following the passing of Justice Ruth Bader Ginsburg, has made the prospects of another round of fiscal stimulus unlikely. The lack of additional stimulus makes the impact of the COVID-19 limitations weigh on many sectors, especially those that are service related, likely stalling any additional economic improvements in the U.S. This is already evident in the labor markets. Initial jobless claims have been flat since late August and small business employment has begun to show signs of weakness.

Despite the doom and gloom, the market correction we have experienced in September should be viewed positively. Throughout the summer months the market seemed to get well ahead of itself and valuations have come down from their highs in August. Market corrections are healthy and normal. They act as a self-correcting mechanism often chasing away speculators. Corrections also provide investors with more attractive entry points into stocks that have strong momentum and sustainable long-term earnings growth. Overall, September was difficult but not necessarily a sign of impending doom. As we enter the final stretch of 2020, we all want to focus on 2021, putting this difficult year behind us. However, I caution you from ignoring the fact that the remaining months of 2020 are likely to be just as unpredictable and volatile as the 9 months that proceeded them. There will likely be more opportunities to take advantage of technical and fundamental dislocations as investor behavior continues to be heavily influenced by the headlines.

This material was prepared by the Spotlight Asset Group (“SAG”) Chief Investment Officer (“CIO”) and is presented for information purposes only. The views offered are those of the author and are subject to change. This information is not intended to provide investment advice or solicit or offer investment advisory services. All information and data presented herein has been obtained from sources believed to be reliable and is believed to be accurate as of the time presented, but SAG does not guarantee its accuracy. You should not make any financial, legal, or tax decisions without consulting with a properly credentialed and experienced professional. Investing involves risk and past performance is no guarantee of future results.