Market Commentary

The positive equity momentum that began in April continued into the month of May. Improving economic data appears to support the thesis that the worst of the economic devastation from the coronavirus lockdowns is behind us. In fact, the most recent data suggests the economic recovery may be much faster than anticipated. This good news, paired with an accommodative U.S. Federal Reserve, has caused a rebound in investors’ appetite for risk.

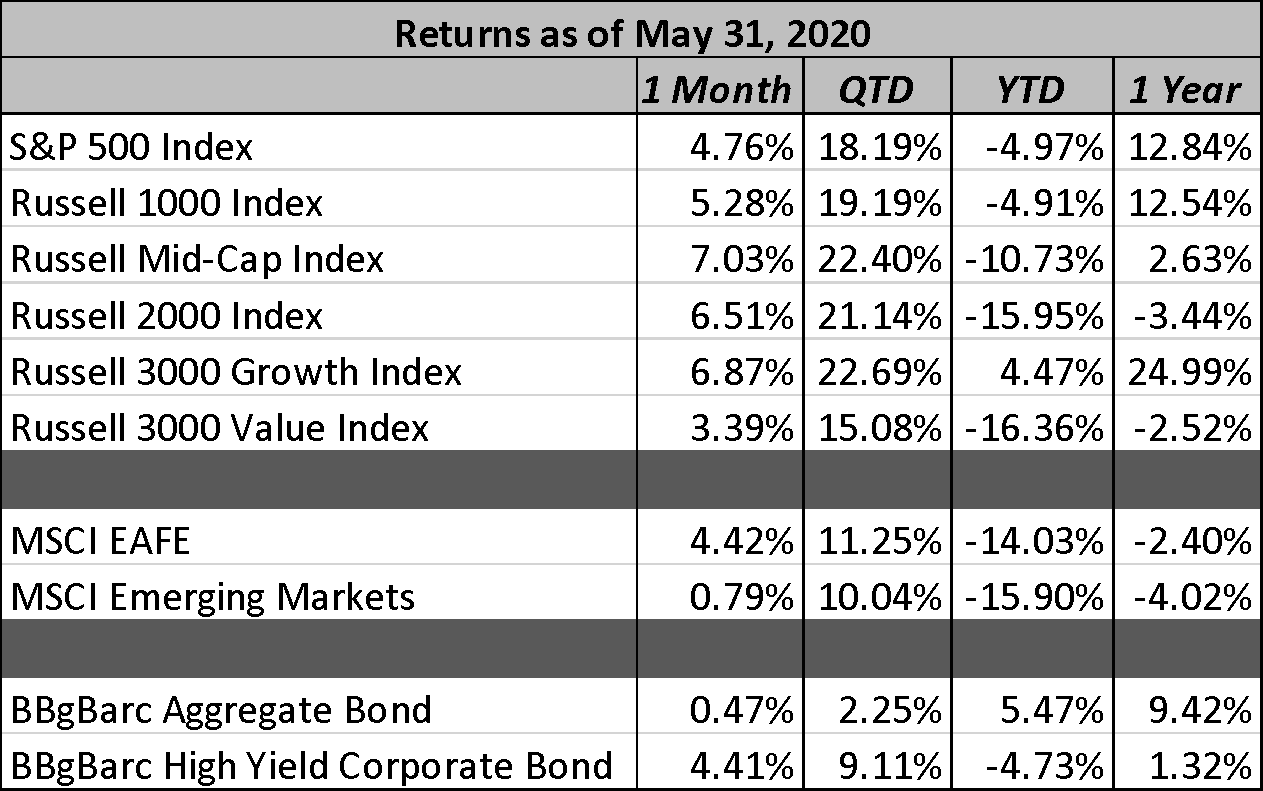

The S&P 500 returned 4.76% during the month, building upon the strength of April. For the second month in a row, mid-cap stocks outperformed both large-caps and small-caps. Non-US developed markets performed in-line with the S&P 500 and both handily outperformed emerging markets. Risk continued to be rewarded in fixed income, with another strong month for high yield bonds.

Across the United States more and more states have begun the reopening process and going into the last weekend of May there appeared plenty of reasons to be optimistic. The most encouraging piece of economic news during the week was the meaningful decline of continuing unemployment claims, the first drop since February. Continued claims fell by 3.86 million, bringing the total number of claims to 21.05 million. This is an important data point as it shows that the gradual reopening of state economies is helping to bring back jobs, albeit gradually. Another positive data point was improving TSA passenger numbers, which rose to 268,867 passengers, up 39% from two weeks ago. While this number is still pitiful in comparison to normal daily travel numbers in the millions, it is yet another sign that Americans are eager to return to some sense of normalcy.

What seems to be true is that the fastest stock market decline in history has been followed by the fastest recovery on record. While many market prognosticators, including myself, felt this downturn would be prolonged and the impact of the lockdowns on the economy would result in a U-shaped recovery, it is quite evident that this was a V-Shaped recovery all along. The recession that started in March is the sharpest downturn we have seen since the Great Depression. As it turns out, it was also the shortest.

The outlook for stocks looks promising from here. While I anticipate corporate earnings to be down substantially in the second quarter, it is unlikely that it will be a prolonged dip. As we know, the stock market is forward looking anyway, so I do not expect the bad news to have much impact on the market’s upward trajectory. That said, nothing about 2020 has been predictable and my crystal ball is a bit foggy these days. Our goal is to position our portfolios to “expect the unexpected”, staying cautiously optimistic, while also maintaining appropriate downside protection.

This material was prepared by the Spotlight Asset Group (“SAG”) Chief Investment Officer (“CIO”) and is presented for information purposes only. The views offered are those of the author and are subject to change. This information is not intended to provide investment advice or solicit or offer investment advisory services. All information and data presented herein has been obtained from sources believed to be reliable and is believed to be accurate as of the time presented, but SAG does not guarantee its accuracy. You should not make any financial, legal, or tax decisions without consulting with a properly credentialed and experienced professional. Investing involves risk and past performance is no guarantee of future results.

Join the Spotlight Asset Group Newsletter

Market Commentary

The positive equity momentum that began in April continued into the month of May. Improving economic data appears to support the thesis that the worst of the economic devastation from the coronavirus lockdowns is behind us. In fact, the most recent data suggests the economic recovery may be much faster than anticipated. This good news, paired with an accommodative U.S. Federal Reserve, has caused a rebound in investors’ appetite for risk.

The S&P 500 returned 4.76% during the month, building upon the strength of April. For the second month in a row, mid-cap stocks outperformed both large-caps and small-caps. Non-US developed markets performed in-line with the S&P 500 and both handily outperformed emerging markets. Risk continued to be rewarded in fixed income, with another strong month for high yield bonds.

Across the United States more and more states have begun the reopening process and going into the last weekend of May there appeared plenty of reasons to be optimistic. The most encouraging piece of economic news during the week was the meaningful decline of continuing unemployment claims, the first drop since February. Continued claims fell by 3.86 million, bringing the total number of claims to 21.05 million. This is an important data point as it shows that the gradual reopening of state economies is helping to bring back jobs, albeit gradually. Another positive data point was improving TSA passenger numbers, which rose to 268,867 passengers, up 39% from two weeks ago. While this number is still pitiful in comparison to normal daily travel numbers in the millions, it is yet another sign that Americans are eager to return to some sense of normalcy.

What seems to be true is that the fastest stock market decline in history has been followed by the fastest recovery on record. While many market prognosticators, including myself, felt this downturn would be prolonged and the impact of the lockdowns on the economy would result in a U-shaped recovery, it is quite evident that this was a V-Shaped recovery all along. The recession that started in March is the sharpest downturn we have seen since the Great Depression. As it turns out, it was also the shortest.

The outlook for stocks looks promising from here. While I anticipate corporate earnings to be down substantially in the second quarter, it is unlikely that it will be a prolonged dip. As we know, the stock market is forward looking anyway, so I do not expect the bad news to have much impact on the market’s upward trajectory. That said, nothing about 2020 has been predictable and my crystal ball is a bit foggy these days. Our goal is to position our portfolios to “expect the unexpected”, staying cautiously optimistic, while also maintaining appropriate downside protection.

This material was prepared by the Spotlight Asset Group (“SAG”) Chief Investment Officer (“CIO”) and is presented for information purposes only. The views offered are those of the author and are subject to change. This information is not intended to provide investment advice or solicit or offer investment advisory services. All information and data presented herein has been obtained from sources believed to be reliable and is believed to be accurate as of the time presented, but SAG does not guarantee its accuracy. You should not make any financial, legal, or tax decisions without consulting with a properly credentialed and experienced professional. Investing involves risk and past performance is no guarantee of future results.