Market Commentary

The month of June was the story of risk-on and risk-off. The alarming rise of coronavirus cases in the United States drove market volatility higher and the headlines helped influence investor risk appetite throughout the month.

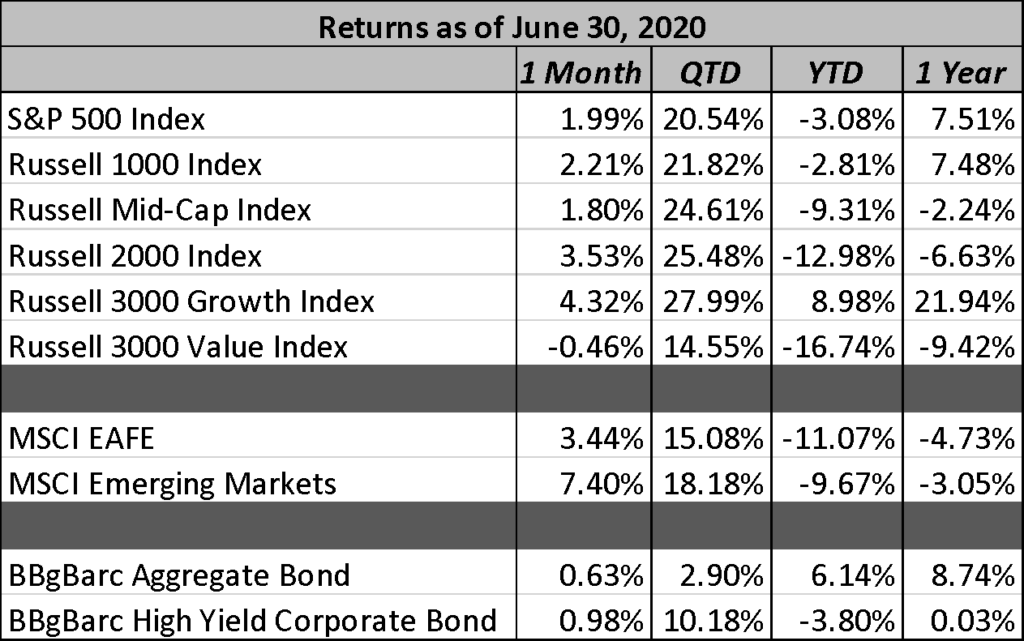

The S&P 500 returned 1.99% during the month. Early month declines were followed by mid-month strength as economic indicators still show a significant rebound in the global economy. Small cap stocks outperformed their larger cap peers and growth, led by technology names, bested value. Non-US developed markets and emerging markets were strong during the month as the spread of the virus appears well contained overseas.

The bifurcated market has been a key characteristic since the sell-off in March. While the Federal Reserve seems quite happy to continue to prop up the bond markets, the equity markets have teetered between risk on and risk off on a daily basis. The market seemed content to look past the rise in new COVID-19 cases and focus more broadly on the rebounding U.S. economy. While many states have put reopening plans on pause, or even reinstated lockdowns in certain areas, the overall trend towards reopening was enough to bolster June non-farm payrolls by 4.8 million, well above the consensus expectations of an increase of 3 million jobs.

In my opinion, the likelihood that states will reinstitute broad lockdowns is low; however, I do think we could see many states dial back their reopening plans or put existing plans on hold for the foreseeable future. The reopening of schools is now a growing debate that is sure to impact the ability of many parents to return to work on a full-time basis. This may mean the strength of any economic rebound will be muted. Initial economic indicators in May and June showed significant rebounding in the global economy, but it is unlikely to maintain that momentum as it is now clear that the fight against the virus is not finished. The developments are quite fluid, and things could certainly change rapidly as we enter July and August. I believe this will cause the volatility of equities to remain elevated and the shift between risk on and risk off will be persistent as news headlines continue to drive market sentiment.

This material was prepared by the Spotlight Asset Group (“SAG”) Chief Investment Officer (“CIO”) and is presented for information purposes only. The views offered are those of the author and are subject to change. This information is not intended to provide investment advice or solicit or offer investment advisory services. All information and data presented herein has been obtained from sources believed to be reliable and is believed to be accurate as of the time presented, but SAG does not guarantee its accuracy. You should not make any financial, legal, or tax decisions without consulting with a properly credentialed and experienced professional. Investing involves risk and past performance is no guarantee of future results.

Join the Spotlight Asset Group Newsletter

Market Commentary

The month of June was the story of risk-on and risk-off. The alarming rise of coronavirus cases in the United States drove market volatility higher and the headlines helped influence investor risk appetite throughout the month.

The S&P 500 returned 1.99% during the month. Early month declines were followed by mid-month strength as economic indicators still show a significant rebound in the global economy. Small cap stocks outperformed their larger cap peers and growth, led by technology names, bested value. Non-US developed markets and emerging markets were strong during the month as the spread of the virus appears well contained overseas.

The bifurcated market has been a key characteristic since the sell-off in March. While the Federal Reserve seems quite happy to continue to prop up the bond markets, the equity markets have teetered between risk on and risk off on a daily basis. The market seemed content to look past the rise in new COVID-19 cases and focus more broadly on the rebounding U.S. economy. While many states have put reopening plans on pause, or even reinstated lockdowns in certain areas, the overall trend towards reopening was enough to bolster June non-farm payrolls by 4.8 million, well above the consensus expectations of an increase of 3 million jobs.

In my opinion, the likelihood that states will reinstitute broad lockdowns is low; however, I do think we could see many states dial back their reopening plans or put existing plans on hold for the foreseeable future. The reopening of schools is now a growing debate that is sure to impact the ability of many parents to return to work on a full-time basis. This may mean the strength of any economic rebound will be muted. Initial economic indicators in May and June showed significant rebounding in the global economy, but it is unlikely to maintain that momentum as it is now clear that the fight against the virus is not finished. The developments are quite fluid, and things could certainly change rapidly as we enter July and August. I believe this will cause the volatility of equities to remain elevated and the shift between risk on and risk off will be persistent as news headlines continue to drive market sentiment.

This material was prepared by the Spotlight Asset Group (“SAG”) Chief Investment Officer (“CIO”) and is presented for information purposes only. The views offered are those of the author and are subject to change. This information is not intended to provide investment advice or solicit or offer investment advisory services. All information and data presented herein has been obtained from sources believed to be reliable and is believed to be accurate as of the time presented, but SAG does not guarantee its accuracy. You should not make any financial, legal, or tax decisions without consulting with a properly credentialed and experienced professional. Investing involves risk and past performance is no guarantee of future results.