Market Commentary

The month of July was a volatile one. Despite the prolonged rise in new cases of COVID-19, the markets remain strong. Economic data early in the month lifted equities higher, but by mid-July, investors seemed to finally realize that we are still at war with the virus and the economic destruction is not necessarily behind us.

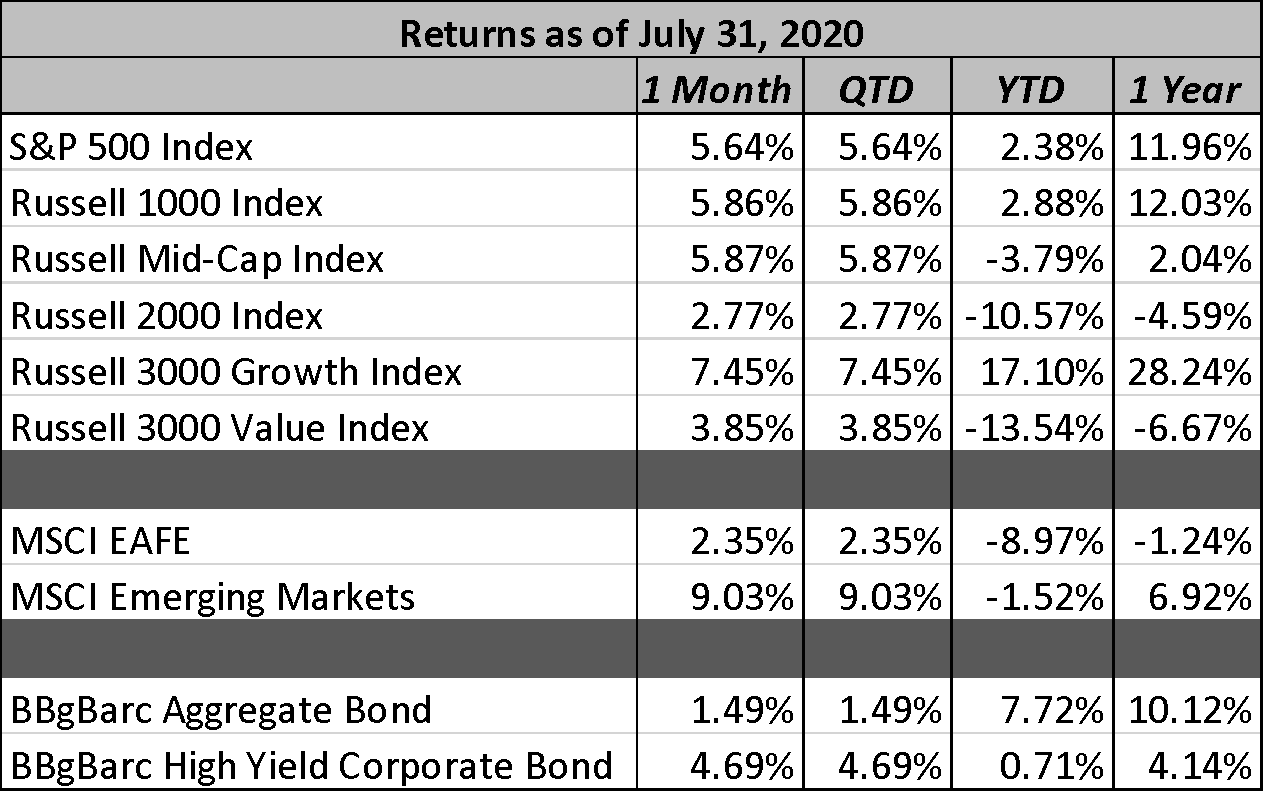

The S&P 500 returned 5.64% during the month. Early month strength was followed by mid-month declines as economic indicators began to turn more negative. Mega cap stocks led the way in July with mid-caps not far behind. Small cap and value-oriented names lagged. Non-US developed markets struggled as they too began to see a second wave impact on their economies. On the flip side emerging markets soared driven by unexpected strength in economic data out of Asia.

Positive vaccine progress and positive economic data early in the month were overshadowed by growing concerns about the resurgence of cases in the United States and abroad. As July reached its halfway point the markets shifted following negative employment data and a decline in consumer spending in parts of the U.S. raised investor concerns that the economic rebound maybe stalling. Breaking a 15-week stretch of declines, U.S. initial jobless claims of 1.42 million were higher than the consensus estimate of 1.3 million and the previous week’s claims of 1.3 million. Growing tensions between the United States and China weighed heavily on sentiment pushing down treasury yields.

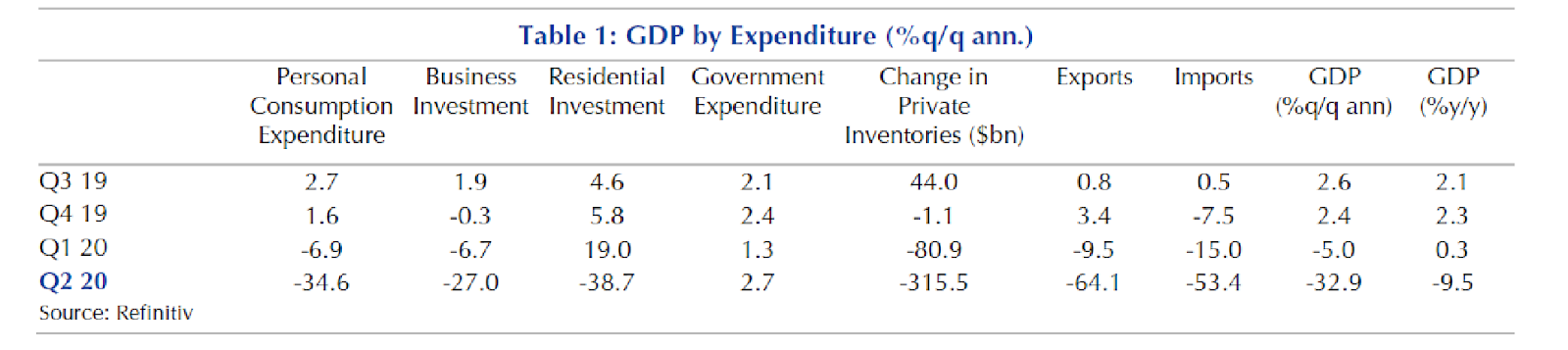

The month ended with a jarring second quarter GDP growth report, showing a jaw dropping -32.9% decline. It’s important to remember this was an annualized number based on the quarterly decline continuing in the future. In actuality Real GDP declined -9.5% from the first quarter to the second quarter. While certainly shocking, it was largely expected as broad lockdowns across the country shut down most business activity for much of the quarter. What was unusual was the fall in GDP was driven by a -34.6% plunge in consumption as the lockdowns in late March and April forced consumers to stay at home. Consumption is not typically the key area that drives GDP declines, but as we already know this downturn is anything but typical. Services consumption was down by -43.5%, with the biggest declines coming in healthcare, as non-essential check-ups and procedures were delayed, recreational services, and spending at bars and restaurants.

Source: Capital Economics US Economics: US Data Response GDP (Q2) July 30, 2020

In some respect the GDP report was old news, as we all knew and expected a massive downturn. The markets have shifted focus to the 3rd quarter and early indications are that the strong rebound in activity we saw in June will likely have leveled off in July. Personal consumption rose 5.6% in June, but renewed lockdowns and increased spread of COVID-19 will likely see that number decline in July. Estimates for non-farm payrolls are down from June but are still expected to be positive. Unemployment, especially continued claims remains elevated. The Federal Reserve remains accommodative and the U.S. government continues to negotiate some sort of extension to the pandemic financial support programs that expired at the end of the July.

Overall, I think it’s important to keep expectations in check. As we’ve seen thus far, the situation with the pandemic is quite fluid and change comes quick. While the strong earnings reports of the tech giants seem to indicate things may not be so bad for equities, it’s still early and technology companies aren’t reflective of all sectors.

This material was prepared by the Spotlight Asset Group (“SAG”) Chief Investment Officer (“CIO”) and is presented for information purposes only. The views offered are those of the author and are subject to change. This information is not intended to provide investment advice or solicit or offer investment advisory services. All information and data presented herein has been obtained from sources believed to be reliable and is believed to be accurate as of the time presented, but SAG does not guarantee its accuracy. You should not make any financial, legal, or tax decisions without consulting with a properly credentialed and experienced professional. Investing involves risk and past performance is no guarantee of future results.

Join the Spotlight Asset Group Newsletter

Market Commentary

The month of July was a volatile one. Despite the prolonged rise in new cases of COVID-19, the markets remain strong. Economic data early in the month lifted equities higher, but by mid-July, investors seemed to finally realize that we are still at war with the virus and the economic destruction is not necessarily behind us.

The S&P 500 returned 5.64% during the month. Early month strength was followed by mid-month declines as economic indicators began to turn more negative. Mega cap stocks led the way in July with mid-caps not far behind. Small cap and value-oriented names lagged. Non-US developed markets struggled as they too began to see a second wave impact on their economies. On the flip side emerging markets soared driven by unexpected strength in economic data out of Asia.

Positive vaccine progress and positive economic data early in the month were overshadowed by growing concerns about the resurgence of cases in the United States and abroad. As July reached its halfway point the markets shifted following negative employment data and a decline in consumer spending in parts of the U.S. raised investor concerns that the economic rebound maybe stalling. Breaking a 15-week stretch of declines, U.S. initial jobless claims of 1.42 million were higher than the consensus estimate of 1.3 million and the previous week’s claims of 1.3 million. Growing tensions between the United States and China weighed heavily on sentiment pushing down treasury yields.

The month ended with a jarring second quarter GDP growth report, showing a jaw dropping -32.9% decline. It’s important to remember this was an annualized number based on the quarterly decline continuing in the future. In actuality Real GDP declined -9.5% from the first quarter to the second quarter. While certainly shocking, it was largely expected as broad lockdowns across the country shut down most business activity for much of the quarter. What was unusual was the fall in GDP was driven by a -34.6% plunge in consumption as the lockdowns in late March and April forced consumers to stay at home. Consumption is not typically the key area that drives GDP declines, but as we already know this downturn is anything but typical. Services consumption was down by -43.5%, with the biggest declines coming in healthcare, as non-essential check-ups and procedures were delayed, recreational services, and spending at bars and restaurants.

Source: Capital Economics US Economics: US Data Response GDP (Q2) July 30, 2020

In some respect the GDP report was old news, as we all knew and expected a massive downturn. The markets have shifted focus to the 3rd quarter and early indications are that the strong rebound in activity we saw in June will likely have leveled off in July. Personal consumption rose 5.6% in June, but renewed lockdowns and increased spread of COVID-19 will likely see that number decline in July. Estimates for non-farm payrolls are down from June but are still expected to be positive. Unemployment, especially continued claims remains elevated. The Federal Reserve remains accommodative and the U.S. government continues to negotiate some sort of extension to the pandemic financial support programs that expired at the end of the July.

Overall, I think it’s important to keep expectations in check. As we’ve seen thus far, the situation with the pandemic is quite fluid and change comes quick. While the strong earnings reports of the tech giants seem to indicate things may not be so bad for equities, it’s still early and technology companies aren’t reflective of all sectors.

This material was prepared by the Spotlight Asset Group (“SAG”) Chief Investment Officer (“CIO”) and is presented for information purposes only. The views offered are those of the author and are subject to change. This information is not intended to provide investment advice or solicit or offer investment advisory services. All information and data presented herein has been obtained from sources believed to be reliable and is believed to be accurate as of the time presented, but SAG does not guarantee its accuracy. You should not make any financial, legal, or tax decisions without consulting with a properly credentialed and experienced professional. Investing involves risk and past performance is no guarantee of future results.