Market Commentary

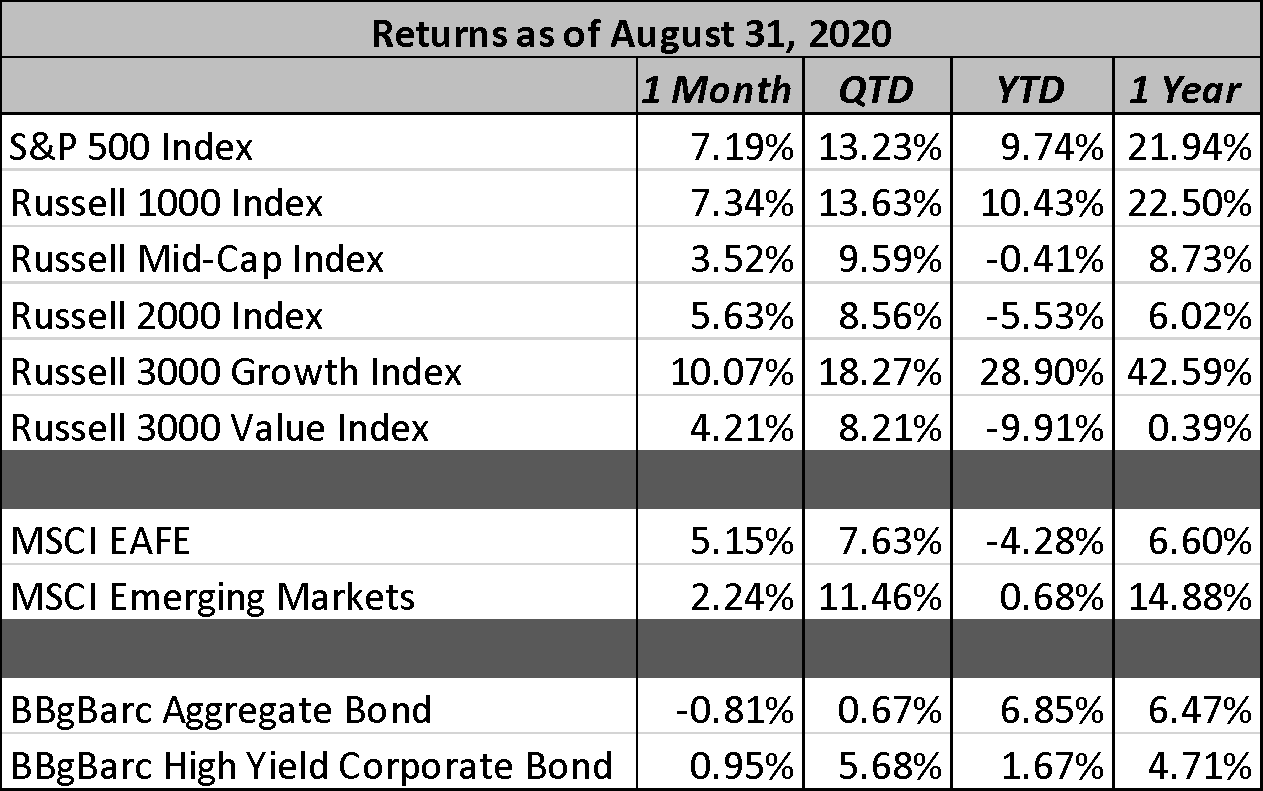

August was a record month for equities, which experienced their best returns since April. The S&P 500 returned +7.19% during the month, riding the continued strength of technology and communication services. Mega cap stocks continued to lead the pack, and growth handily outperformed value. Non-US developed markets rebounded a bit from July. Emerging markets were the key area of weakness for global equities in August. Chairman Powell’s statement in late August marked a new strategy for the Federal Reserve. One that placed greater emphasis on maximum employment vs. managing inflation targets. This suggests the Fed will maintain looser policy over the next cycle. The news led to weakness for fixed income, with the Barclays Aggregate Bond Index finishing the month in the red, down -0.81%.

Progress in the fight against COVID-19 remained positive as several promising developments were reported during the month. Abbott Laboratories announced the FDA had given them the green light to begin manufacturing its $5 rapid result COVID-19 test. This test is a potential game changer as it allows for much quicker identification of individuals with the virus and can halt the spread much more quickly than in the past. Additionally, Moderna announced positive results from their current vaccine trials, particularly within the high-risk category of the population, those ages 65 and older. This progress paired with the slowing of the second wave in the U.S. as well as largely positive economic data helped drive stock prices higher.

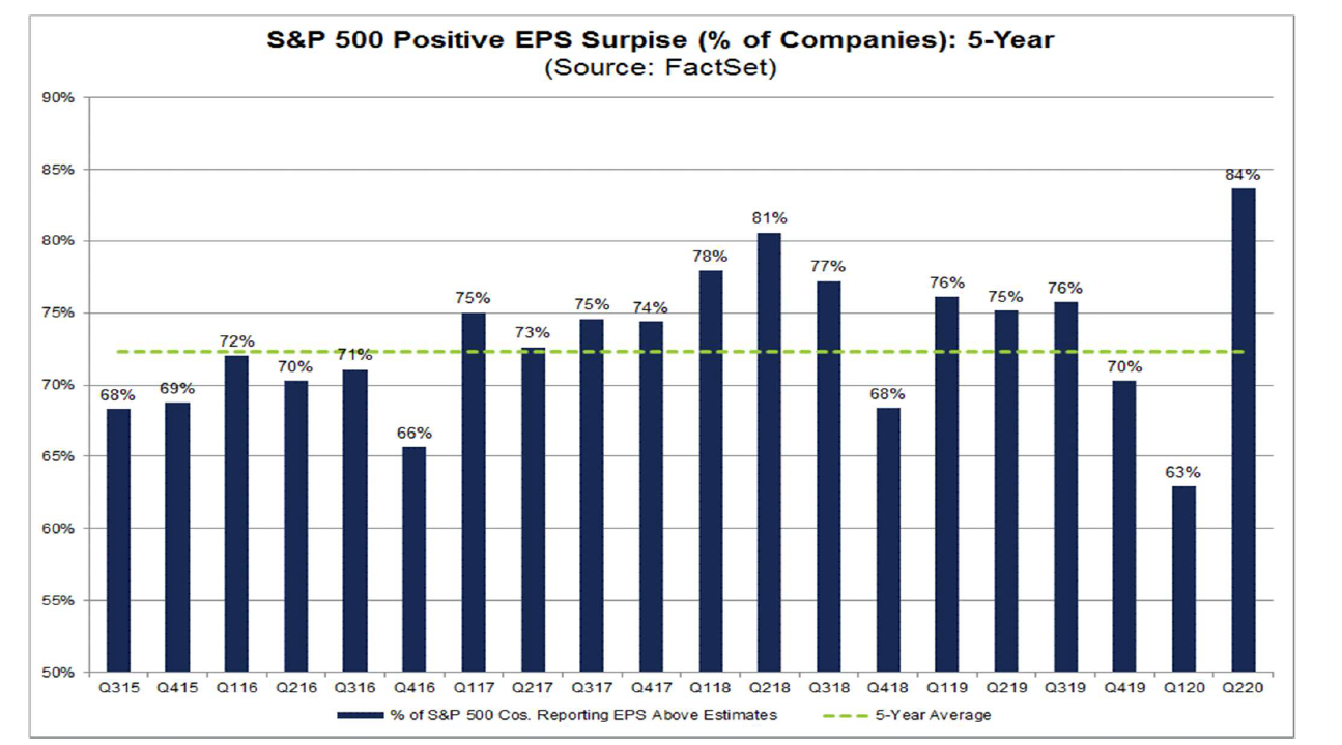

As Q2 2020 earnings season has come to a close, S&P 500 companies largely reported stronger earnings than expected. Per FactSet’s recently released Earnings Insight report, as of August month-end, 98% of the companies had reported results, 84% of which reported a positive earnings surprise, 65% reported a positive revenue surprise. If 84% is the final percentage, it will mark the highest percentage of S&P 500 companies reporting a positive EPS surprise since FactSet began tracking this metric in 2008.

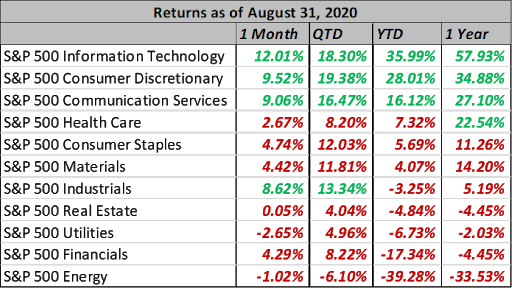

A lot of attention has been given to valuations of late, and for good reason. With markets reaching new highs while the global economy remains constrained by the pandemic, equities do appear quite frothy. What is more interesting is the dispersion of returns. Year to date, information technology has been the best performing sector, returning a remarkable +35.99% vs. the worst performer, energy, which has declined -39.28% over the same period. In fact, only 3 sectors are responsible for the strong returns we’ve seen: Information Technology, Consumer Discretionary and Communication Services.

That disparity in returns largely explains the deep divide between growth and value. As the value indices are heavily weighted to energy, financials, and utilities, all of which have lagged the broad markets. Most forget the relationship between growth and value is secular and tends to persist over many years. Today, low interest rates and specific sector challenges serve as a headwind to value stocks, but the relationship will reverse at some point in the future. It always does. The recent sell-off reminds us the importance and rebalancing. The markets certainly have a way of keeping us humble.

This material was prepared by the Spotlight Asset Group (“SAG”) Chief Investment Officer (“CIO”) and is presented for information purposes only. The views offered are those of the author and are subject to change. This information is not intended to provide investment advice or solicit or offer investment advisory services. All information and data presented herein has been obtained from sources believed to be reliable and is believed to be accurate as of the time presented, but SAG does not guarantee its accuracy. You should not make any financial, legal, or tax decisions without consulting with a properly credentialed and experienced professional. Investing involves risk and past performance is no guarantee of future results.

Join the Spotlight Asset Group Newsletter

Market Commentary

August was a record month for equities, which experienced their best returns since April. The S&P 500 returned +7.19% during the month, riding the continued strength of technology and communication services. Mega cap stocks continued to lead the pack, and growth handily outperformed value. Non-US developed markets rebounded a bit from July. Emerging markets were the key area of weakness for global equities in August. Chairman Powell’s statement in late August marked a new strategy for the Federal Reserve. One that placed greater emphasis on maximum employment vs. managing inflation targets. This suggests the Fed will maintain looser policy over the next cycle. The news led to weakness for fixed income, with the Barclays Aggregate Bond Index finishing the month in the red, down -0.81%.

Progress in the fight against COVID-19 remained positive as several promising developments were reported during the month. Abbott Laboratories announced the FDA had given them the green light to begin manufacturing its $5 rapid result COVID-19 test. This test is a potential game changer as it allows for much quicker identification of individuals with the virus and can halt the spread much more quickly than in the past. Additionally, Moderna announced positive results from their current vaccine trials, particularly within the high-risk category of the population, those ages 65 and older. This progress paired with the slowing of the second wave in the U.S. as well as largely positive economic data helped drive stock prices higher.

As Q2 2020 earnings season has come to a close, S&P 500 companies largely reported stronger earnings than expected. Per FactSet’s recently released Earnings Insight report, as of August month-end, 98% of the companies had reported results, 84% of which reported a positive earnings surprise, 65% reported a positive revenue surprise. If 84% is the final percentage, it will mark the highest percentage of S&P 500 companies reporting a positive EPS surprise since FactSet began tracking this metric in 2008.

A lot of attention has been given to valuations of late, and for good reason. With markets reaching new highs while the global economy remains constrained by the pandemic, equities do appear quite frothy. What is more interesting is the dispersion of returns. Year to date, information technology has been the best performing sector, returning a remarkable +35.99% vs. the worst performer, energy, which has declined -39.28% over the same period. In fact, only 3 sectors are responsible for the strong returns we’ve seen: Information Technology, Consumer Discretionary and Communication Services.

That disparity in returns largely explains the deep divide between growth and value. As the value indices are heavily weighted to energy, financials, and utilities, all of which have lagged the broad markets. Most forget the relationship between growth and value is secular and tends to persist over many years. Today, low interest rates and specific sector challenges serve as a headwind to value stocks, but the relationship will reverse at some point in the future. It always does. The recent sell-off reminds us the importance and rebalancing. The markets certainly have a way of keeping us humble.

This material was prepared by the Spotlight Asset Group (“SAG”) Chief Investment Officer (“CIO”) and is presented for information purposes only. The views offered are those of the author and are subject to change. This information is not intended to provide investment advice or solicit or offer investment advisory services. All information and data presented herein has been obtained from sources believed to be reliable and is believed to be accurate as of the time presented, but SAG does not guarantee its accuracy. You should not make any financial, legal, or tax decisions without consulting with a properly credentialed and experienced professional. Investing involves risk and past performance is no guarantee of future results.