Market Commentary

The old saying goes “April Showers bring May Flowers” and while that might certainly be true for the weather here in Northern Illinois, I’m not convinced it will apply to the stock market, as the economic impact of the global lockdown starts to affect earnings reports in the next few months.

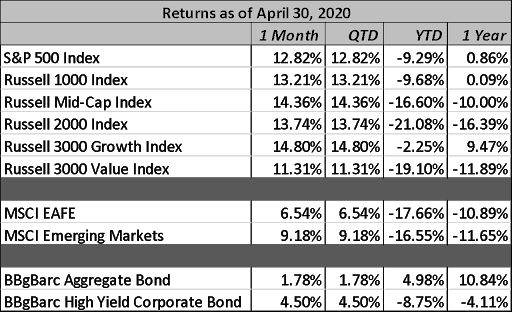

After an abysmal March, April brought positive returns across all major asset classes. The S&P 500 returned 12.82% during the month, recovering significantly from the lows of a month ago. Mid-cap stocks bested both large-caps and small-caps. U.S. markets sizably outperformed their non-U.S. counterparts, and emerging markets beat developed markets by a wide margin. April proved to be a risk-on market with high yield bonds handily outperforming investment grade.

Largely positive April returns are certainly not reflective of the unprecedented economic crisis we are experiencing. The main thought on investors’ minds is whether the market will retest the March lows. Personally, I believe that to be a likely scenario. As states work on their plans to reopen, any indications that the lockdowns will continue through the summer months will not be viewed favorably by the markets. This will be especially true as April economic data offers investors a glimpse into the economic damage being done. Markets like clarity and if a clearer picture does not emerge for how the reopening will unfold, I expect the markets will continue to be volatile.

The next question seems to be is are the markets fairly-valued. Down about 12% from all-time highs does not seem to suggest they are. To date, 55% of S&P 500 companies have reported first quarter earnings. As more companies release their earnings, second quarter guidance has maintained a somber tone. Per FactSet’s recently released Earnings Insight report ¹, analyst consensus estimates for S&P 500 second quarter earnings fell 28.4%, from $36.94 to $26.46. This marked the largest decline in the quarterly EPS estimate over the first month of a quarter since FactSet began tracking this data in the first quarter 2002. The market will need to recalibrate expectations currently reflected in stock prices. This again supports the thesis that continued downside risk remains in equity markets.

The counter argument, of course, is that the Federal Reserve has taken aggressive action in an attempt to buoy the markets. This “reflation trade”, which seeks to reduce risk premiums and reflate risk assets, appears to be having the desired effect. This certainly helps limit the floor for equities, but I still believe downside risk remains.

The counter argument, of course, is that the Federal Reserve has taken aggressive action in an attempt to buoy the markets. This “reflation trade”, which seeks to reduce risk premiums and reflate risk assets, appears to be having the desired effect. This certainly helps limit the floor for equities, but I still believe downside risk remains.

The good news is that the very worst of the economic hit from the COVID-19 driven lockdowns is likely behind us. As more and more states begin to relax restrictions on their local economies, gradual improvements are likely to be seen. This process will be slow and deliberate, but nonetheless a step in the right direction.

¹ FACTSET Earnings Insight May 1, 2020 https://www.factset.com/earningsinsight

This material was prepared by the Spotlight Asset Group (“SAG”) Chief Investment Officer (“CIO”) and is presented for information purposes only. The views offered are those of the author and are subject to change. This information is not intended to provide investment advice or solicit or offer investment advisory services. All information and data presented herein has been obtained from sources believed to be reliable and is believed to be accurate as of the time presented, but SAG does not guarantee its accuracy. You should not make any financial, legal, or tax decisions without consulting with a properly credentialed and experienced professional. Investing involves risk and past performance is no guarantee of future results.

Join the Spotlight Asset Group Newsletter

Market Commentary

The old saying goes “April Showers bring May Flowers” and while that might certainly be true for the weather here in Northern Illinois, I’m not convinced it will apply to the stock market, as the economic impact of the global lockdown starts to affect earnings reports in the next few months.

After an abysmal March, April brought positive returns across all major asset classes. The S&P 500 returned 12.82% during the month, recovering significantly from the lows of a month ago. Mid-cap stocks bested both large-caps and small-caps. U.S. markets sizably outperformed their non-U.S. counterparts, and emerging markets beat developed markets by a wide margin. April proved to be a risk-on market with high yield bonds handily outperforming investment grade.

Largely positive April returns are certainly not reflective of the unprecedented economic crisis we are experiencing. The main thought on investors’ minds is whether the market will retest the March lows. Personally, I believe that to be a likely scenario. As states work on their plans to reopen, any indications that the lockdowns will continue through the summer months will not be viewed favorably by the markets. This will be especially true as April economic data offers investors a glimpse into the economic damage being done. Markets like clarity and if a clearer picture does not emerge for how the reopening will unfold, I expect the markets will continue to be volatile.

The next question seems to be is are the markets fairly-valued. Down about 12% from all-time highs does not seem to suggest they are. To date, 55% of S&P 500 companies have reported first quarter earnings. As more companies release their earnings, second quarter guidance has maintained a somber tone. Per FactSet’s recently released Earnings Insight report ¹, analyst consensus estimates for S&P 500 second quarter earnings fell 28.4%, from $36.94 to $26.46. This marked the largest decline in the quarterly EPS estimate over the first month of a quarter since FactSet began tracking this data in the first quarter 2002. The market will need to recalibrate expectations currently reflected in stock prices. This again supports the thesis that continued downside risk remains in equity markets.

The counter argument, of course, is that the Federal Reserve has taken aggressive action in an attempt to buoy the markets. This “reflation trade”, which seeks to reduce risk premiums and reflate risk assets, appears to be having the desired effect. This certainly helps limit the floor for equities, but I still believe downside risk remains.

The counter argument, of course, is that the Federal Reserve has taken aggressive action in an attempt to buoy the markets. This “reflation trade”, which seeks to reduce risk premiums and reflate risk assets, appears to be having the desired effect. This certainly helps limit the floor for equities, but I still believe downside risk remains.

The good news is that the very worst of the economic hit from the COVID-19 driven lockdowns is likely behind us. As more and more states begin to relax restrictions on their local economies, gradual improvements are likely to be seen. This process will be slow and deliberate, but nonetheless a step in the right direction.

¹ FACTSET Earnings Insight May 1, 2020 https://www.factset.com/earningsinsight

This material was prepared by the Spotlight Asset Group (“SAG”) Chief Investment Officer (“CIO”) and is presented for information purposes only. The views offered are those of the author and are subject to change. This information is not intended to provide investment advice or solicit or offer investment advisory services. All information and data presented herein has been obtained from sources believed to be reliable and is believed to be accurate as of the time presented, but SAG does not guarantee its accuracy. You should not make any financial, legal, or tax decisions without consulting with a properly credentialed and experienced professional. Investing involves risk and past performance is no guarantee of future results.