Expanded Child Tax Credit

Expanded Child Tax Credit

On July 15, 2021, many parents with kids 17 years or younger woke up with a nice surprise in their bank account – additional money from the Internal Revenue Service (“IRS”). Nearly $15 billion was paid to families in the first monthly payment of the expanded Child Tax Credit. If you received the credit (or wondering why you didn’t), I’m here to help with answers to some frequent questions we’ve seen.

What is the payment for?

Under the American Rescue Plan, passed by Congress in March, taxpayers can claim a credit up to $3,600 per child under the age of 6 and up to $3,000 for children between 6 and 17. This credit is not new, however there are significant changes to the credit you could previously take. Historically, a taxpayer could claim a maximum of $2,000 per child for children 16 and under and you would claim the credit at the time you filed your tax return. As part of the American Rescue Plan, this was changed so that half of the credit would be paid in monthly installments beginning on July 15, 2021, and the remaining would be taken as a credit at tax time.

Additionally, the credit in prior years was partially refundable, meaning if you didn’t owe any taxes, you could only claim a partial amount of the credit as a refund ($1,400). The new legislation makes this credit fully refundable now, i.e., if you don’t owe taxes in 2021, you can still receive a refund for the full amount of the credit.

Who is eligible?

You qualify for the full credit if you are a single tax filer with a modified adjusted gross income (“MAGI”) of $75,000 or less, a head of household filer with a MAGI of $112,500 or less or a married filing jointly taxpayers with a MAGI of $150,000 or less. The credit phases out for taxpayers who exceed these income thresholds.

The IRS will use your 2020 return to determine the amount of credit you should receive. If you haven’t filed your 2020 return yet, the IRS will use information from your 2019 return. If you did not receive any or the full amount of the credit because your income was too high in 2019 or your child was not included on the 2019 return, file your 2020 return as soon as possible. The payment will then start the month after your 2020 tax return is processed. Per the IRS, later this year they will allow you to inform them of any children you can claim on your 2021 return (if different than the 2020 return) so they can adjust the estimated credit.

How much should I have received?

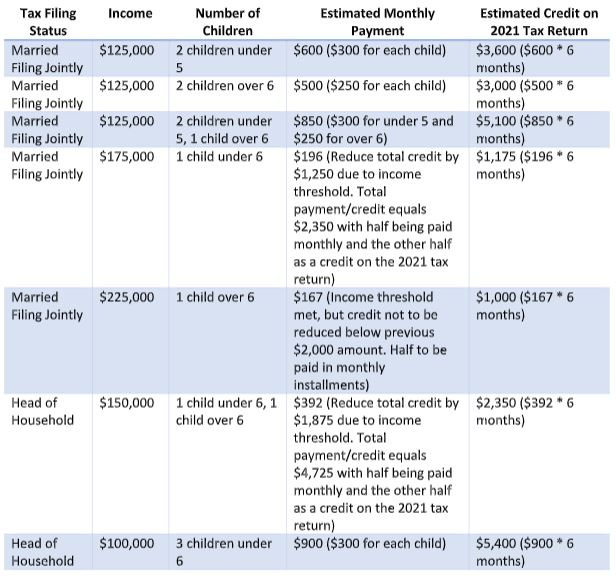

The amount received will depends on income, number of children you have and their ages. The monthly payment begins to reduce by $50 for every $1,000 of income (or fraction thereof) earned over the income thresholds. Higher-income families whose income is above the thresholds are still eligible for the

$2,000 per child benefit received in the past, as long as their incomes are less than $200,000 for single or Head of Household filers or $400,000 for married filing jointly filers. Below are a few examples of how to calculate the amount of credit and payment to be received.

How do I opt out?

The IRS created a Child Tax Credit Update Portal (https://www.irs.gov/credits-deductions/child-tax-credit-update-portal) which allows you to view your payments online and/or opt out of the program. You only need to unenroll from the program once and you will be unenrolled for the months going forward. However, it is important to note that you if you unenroll, you are not able to re-enroll at this time. The IRS has indicated that they will open the portal up for taxpayers wanting to re-enroll in late September. A word of warning – setting up your login for the portal can be fairly time intensive and requires you to have pictures of the front and back of your driver’s license.

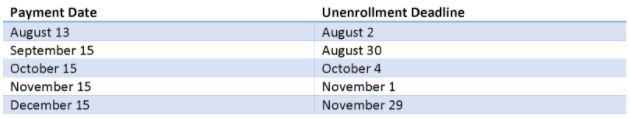

If you would like to opt out, you will need to do so at least three days before the first Thursday of each month. The opt out deadlines are illustrated below for each month. Note that if you file jointly, each parent needs to unenroll or the spouse who does not opt out will receive half of the joint payment. If you miss an unenrollment deadline, you will receive the next scheduled payment until the IRS processes your request to unenroll. For example, if you unenroll on August 4, you will receive a payment on August 13, but should not receive the September 15 payment.

What if I did not receive anything?

Advanced child tax credit payments were sent to most families via direct deposit if the IRS had banking information on file. You can see the status of your payments via the Child Tax Credit Update Portal. When reviewing your bank account, look for a deposit labeled “CHILDCTC”. If the IRS did not have banking information on file, the payments were sent via check to the mailing address the IRS has on file.

If you are still missing your payments, the IRS has setup a system to track your payments. If your direct deposit is more than 5 days late, a check to a standard mailing address is more than 4 weeks late or a check mailed to a forwarding address is more than 6 weeks late, you can mail or fax a Form 3911 to the IRS. This will open an inquiry into the location of your funds, although the IRS states it may take up to six weeks before obtaining a result.

Will this continue in future years?

As of now, the expansion of the Child Tax Credit is only in effect for 2021 and without further legislation, will return to previous levels in 2022.

If you have any questions regarding the Expanded Child Tax Credit, please reach out to your advisor or Bethany Riesenberg, CFO at riesenberg@spotlightassetgroup.com.

This material was prepared by the Spotlight Asset Group (“SAG”) Chief Financial Officer (“CFO”) and is presented for information purposes only. This information is not intended to provide legal, tax, accounting, financial or other advice. All information and data

Bethany Riesenberg

Join the Spotlight Asset Group Newsletter

Expanded Child Tax Credit

On July 15, 2021, many parents with kids 17 years or younger woke up with a nice surprise in their bank account – additional money from the Internal Revenue Service (“IRS”). Nearly $15 billion was paid to families in the first monthly payment of the expanded Child Tax Credit. If you received the credit (or wondering why you didn’t), I’m here to help with answers to some frequent questions we’ve seen.

What is the payment for?

Under the American Rescue Plan, passed by Congress in March, taxpayers can claim a credit up to $3,600 per child under the age of 6 and up to $3,000 for children between 6 and 17. This credit is not new, however there are significant changes to the credit you could previously take. Historically, a taxpayer could claim a maximum of $2,000 per child for children 16 and under and you would claim the credit at the time you filed your tax return. As part of the American Rescue Plan, this was changed so that half of the credit would be paid in monthly installments beginning on July 15, 2021, and the remaining would be taken as a credit at tax time.

Additionally, the credit in prior years was partially refundable, meaning if you didn’t owe any taxes, you could only claim a partial amount of the credit as a refund ($1,400). The new legislation makes this credit fully refundable now, i.e., if you don’t owe taxes in 2021, you can still receive a refund for the full amount of the credit.

Who is eligible?

You qualify for the full credit if you are a single tax filer with a modified adjusted gross income (“MAGI”) of $75,000 or less, a head of household filer with a MAGI of $112,500 or less or a married filing jointly taxpayers with a MAGI of $150,000 or less. The credit phases out for taxpayers who exceed these income thresholds.

The IRS will use your 2020 return to determine the amount of credit you should receive. If you haven’t filed your 2020 return yet, the IRS will use information from your 2019 return. If you did not receive any or the full amount of the credit because your income was too high in 2019 or your child was not included on the 2019 return, file your 2020 return as soon as possible. The payment will then start the month after your 2020 tax return is processed. Per the IRS, later this year they will allow you to inform them of any children you can claim on your 2021 return (if different than the 2020 return) so they can adjust the estimated credit.

How much should I have received?

The amount received will depends on income, number of children you have and their ages. The monthly payment begins to reduce by $50 for every $1,000 of income (or fraction thereof) earned over the income thresholds. Higher-income families whose income is above the thresholds are still eligible for the $2,000 per child benefit received in the past, as long as their incomes are less than $200,000 for single or Head of Household filers or $400,000 for married filing jointly filers.

Below are a few examples of how to calculate the amount of credit and payment to be received.

Is there anything I need to do?

Estimate your income levels for 2021 to determine if they differ from 2020, especially if you jump over one of the income thresholds. If your income increases enough such that you exceed the income thresholds, you may need to pay back a significant amount of the credit when you file your tax return. In this case, it may make sense to opt out of the monthly payments.

Additionally, if you have a child who no longer lives with you, but you claimed them as a dependent on your 2020 taxes, you most likely want to opt out or again, you will have to pay back during tax season.

How do I opt out?

The IRS created a Child Tax Credit Update Portal (https://www.irs.gov/credits-deductions/child-tax-credit-update-portal) which allows you to view your payments online and/or opt out of the program. You only need to unenroll from the program once and you will be unenrolled for the months going forward. However, it is important to note that you if you unenroll, you are not able to re-enroll at this time. The IRS has indicated that they will open the portal up for taxpayers wanting to re-enroll in late September. A word of warning – setting up your login for the portal can be fairly time intensive and requires you to have pictures of the front and back of your driver’s license.

If you would like to opt out, you will need to do so at least three days before the first Thursday of each month. The opt out deadlines are illustrated below for each month. Note that if you file jointly, each parent needs to unenroll or the spouse who does not opt out will receive half of the joint payment. If you miss an unenrollment deadline, you will receive the next scheduled payment until the IRS processes your request to unenroll. For example, if you unenroll on August 4, you will receive a payment on August 13, but should not receive the September 15 payment.

What if I did not receive anything?

Advanced child tax credit payments were sent to most families via direct deposit if the IRS had banking information on file. You can see the status of your payments via the Child Tax Credit Update Portal. When reviewing your bank account, look for a deposit labeled “CHILDCTC”. If the IRS did not have banking information on file, the payments were sent via check to the mailing address the IRS has on file.

If you are still missing your payments, the IRS has setup a system to track your payments. If your direct deposit is more than 5 days late, a check to a standard mailing address is more than 4 weeks late or a check mailed to a forwarding address is more than 6 weeks late, you can mail or fax a Form 3911 to the IRS. This will open an inquiry into the location of your funds, although the IRS states it may take up to six weeks before obtaining a result.

Will this continue in future years?

As of now, the expansion of the Child Tax Credit is only in effect for 2021 and without further legislation, will return to previous levels in 2022.

If you have any questions regarding the Expanded Child Tax Credit, please reach out to your advisor or Bethany Riesenberg, CFO at riesenberg@spotlightassetgroup.com.

This material was prepared by the Spotlight Asset Group (“SAG”) Chief Financial Officer (“CFO”) and is presented for information purposes only. This information is not intended to provide legal, tax, accounting, financial or other advice. All information and data

Bethany Riesenberg